tax avoidance vs tax evasion south africa

This preview shows page 1 out of 1 page. The terms tax avoidance and tax evasion are often used interchangeably but they are very different concepts.

Tax Revenue Mobilisation Estimates Of South Africa S Personal Income Tax Gap

Tax avoidance is using the taxation regime to ones own.

. Nevertheless the basic distinction that tax evasion is a criminal act with penal consequences whilst tax avoidance may attract only an assessment to tax which the taxpayer sought to avoid remains unimpaired3 Tax evasion involves the making of false state ments or the use of fraudulent means to reduce or avoid the obligation. Affairs in a perfectly legal manner so that he has either reduced his income. The difference between tax avoidance and tax evasion boils down to the element of concealing.

Tax avoidance means legally reducing your taxable income. Tax evasionThe failure to pay or a deliberate underpayment of taxes. Businesses get into trouble with the IRS when they intentionally evade taxes.

Tax evasion on the other hand is usually characterised by fraud and deceit. Staff Writer 14 September 2021. A worthwhile read to understand how revenue authorities are seeing things.

Underground economyMoney-making activities that people dont report to the government including both illegal and legal activities. Diuga highlights the difference between evasion planning and avoidance. It is reasonable to presume that anyone would want to pay less tax and therefore it is legal to implement ways in which to do so by use of mechanisms available under present laws and regulations.

Or has no income on which tax is payable. These two phenomena better captured by the concept of wage evasion than tax evasion concretely mean that South Africa. Tax avoidanceAn action taken to lessen tax liability and maximize after-tax income.

Tax Evasion vs. Using unlawful methods to pay less or no tax. Tax Evasion vs.

Is one of South Africas leading news and information websites. Httpsbitly3rXvZFs taxshop makelifeeasier. Tax evasion means concealing income or information from tax authorities and its illegal.

While tax evasion was generally regarded as an illegal and dishonest means to escape tax tax avoidance was viewed as a legitimate and continue reading Continue reading. The principle of evading payment of taxes by use of illegal means is to be frowned. Tax Evasion is illegal.

In instances of tax avoidance the severity of the punishment is often dependent on whether or not it can be proven that the taxpayer willfully withheld declaring assets like an overseas bank account or a pension. TAX EVASION TAX AVOIDANCE The term tax evasion summarizes any action taken to avoid or reduce tax by illegal means. Tax Avoidance is legal.

Businesses avoid taxes by taking all legitimate deductions and by sheltering income from taxes by setting up employee retirement plans and other means all legal and under the Internal Revenue Code or state tax codes. Characterised by open and full disclosure where a taxpayer has arranged his. Usually this constitutes fraud ie falsifying statements or presenting false information to the South African Revenue Service SARS with penalties including imprisonment.

While you get reduced taxes with tax avoidance tax evasion can result in. Tax avoidance understood as the use of the so-called loopholes in the tax legislation to reduce ones tax. Diuga highlights the difference between evasion planning and avoidance.

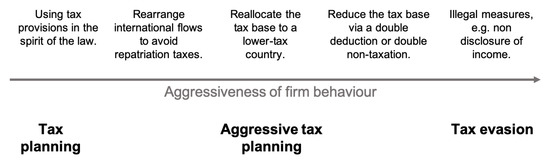

However this first part also shows that the impacts for South Africa are not only in terms of taxes and public revenues losses. Tax Avoidance vs Tax Evasion. Thus in the past it was generally accepted that there was a simple distinction between unlawful tax evasion and lawful tax avoidance.

Using unlawful methods to pay less or no tax. Tax Avoidance and Evasion in Africa. In tax avoidance you structure your affairs to pay the least possible amount of tax due.

Basically tax avoidance is legal while tax evasion is not. People who engage in tax avoidance or tax evasion often must answer for their decisions to withhold taxable income from the IRS. In tax evasion you hide or lie about your income and assets altogether.

By contrast tax evasion is the general term for efforts by individuals firms trusts and other entities to evade the payment of taxes by illegal means. TAX EVASION VS TAX AVOIDANCE. Tax avoidance versus tax evasion The difference between tax avoidance and evasion is important due to the legal implications.

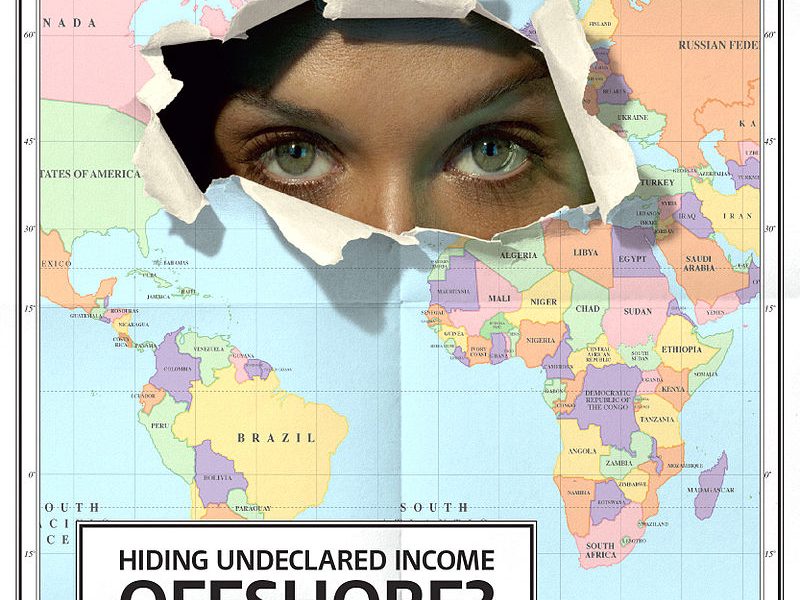

91621 1050 PM Tax evasion vs tax avoidance in South Africa and why SARS wants you to pay your fair share 511 Impermissible avoidance arrangement and updated GAAR 80 A-L Tax avoidance is typically described as the use of impermissible avoidance arrangements Overberg Asset Management noted that the 2006 amendments. Examples of tax avoidance involve using tax deductions changing ones business structure through incorporation or establishing an offshore company in a tax haven. There is not so much of a fine line between tax evasion.

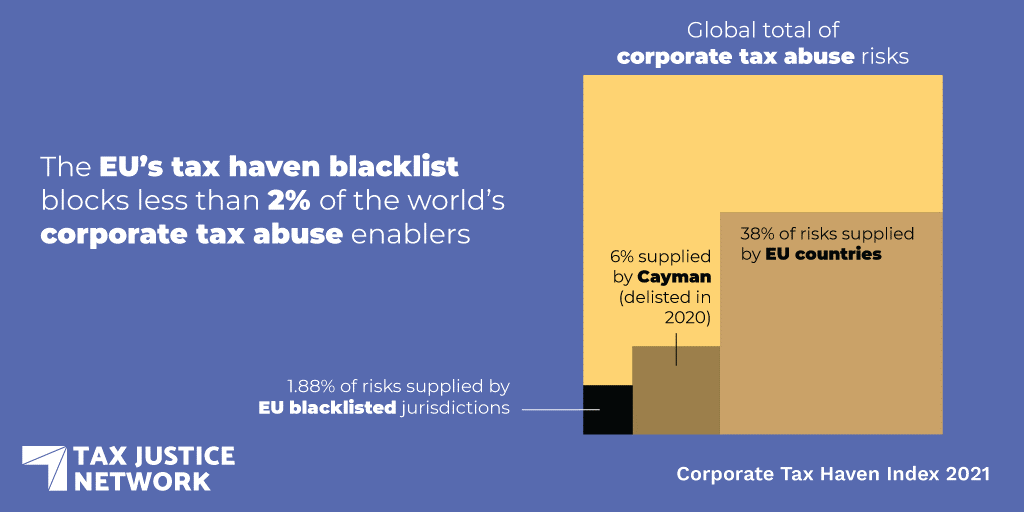

Illicit financial flows also mean lower wages and chronic shortages of local savings. When considering evasion vs avoidance there are different tax reducing acts which will depend on the tax type at hand. Tax avoidance tax evasion tax heavens illicit financial flows and global tax governance are real buzzwords that have come to dominate current international political and financial domains.

Usually this constitutes fraud ie falsifying statements or presenting false information to the South African Revenue Service SARS with penalties including imprisonment. Tax avoidance is the legitimate minimizing of taxes using methods included in the tax code. While tax evasion requires the use of illegal methods to avoid paying proper taxes tax avoidance uses legal means to.

Tax evasion vs tax avoidance in South Africa and why SARS wants you to pay your fair share.

South Africa Tax Treaty International Tax Treaty Freeman Law

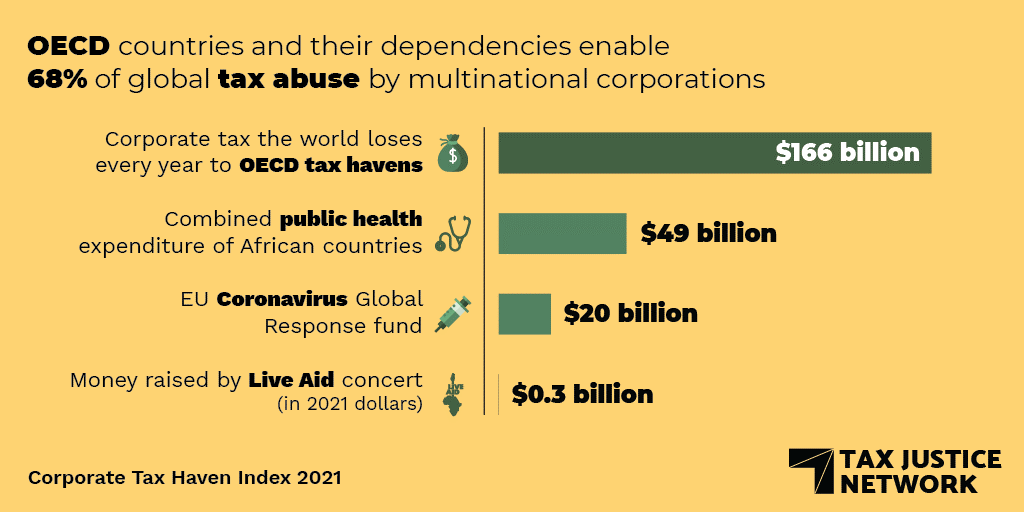

427 Billion Lost To Tax Havens Every Year Global Alliance For Tax Justice

/f/81332/1417x813/417672df43/en-corporate-income-tax-rectangle.PNG)

Developing Countries More At Risk Of Lost Corporate Tax Revenues

Africa And The Corrosive International Tax System Tax Justice Network

Tax Revenue Mobilisation Estimates Of South Africa S Personal Income Tax Gap

Tax Avoidance Vs Tax Evasion Infographic Fincor

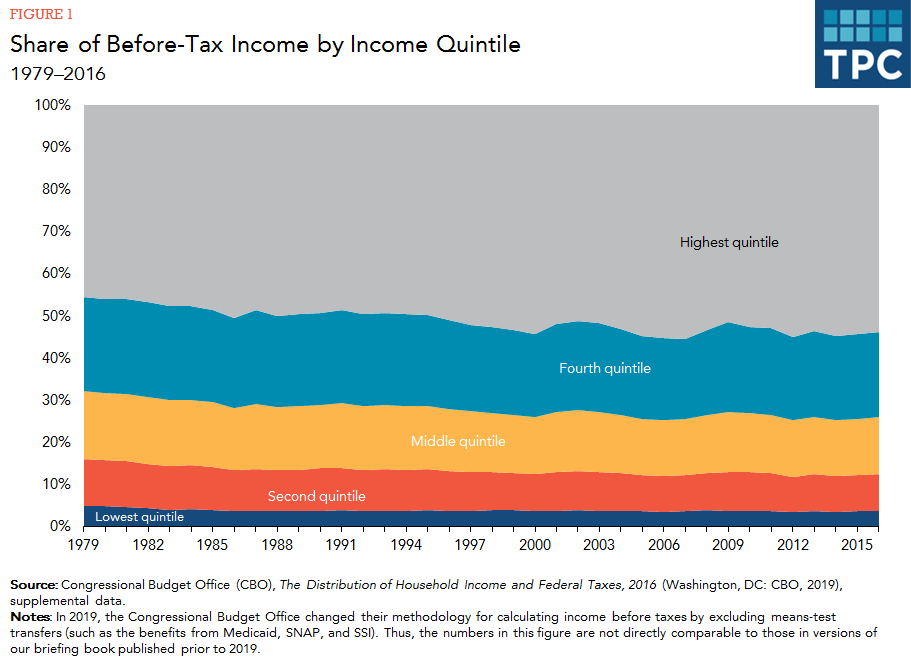

How Do Taxes Affect Income Inequality Tax Policy Center

Africa S Problem With Tax Avoidance Africa Dw 17 06 2021

Differences Between Tax Evasion Tax Avoidance And Tax Planning

Guest Blog Tax Avoidance And Evasion In Africa Tax Justice Network

Tax Avoidance Costs The U S Nearly 200 Billion Every Year Infographic

Secret Bank Accounts Income Inequality And Why Luxembourg Matters Financial Wealth Bank Account Global Economy

Games Free Full Text Gaming The System An Investigation Of Small Business Owners Attitudes To Tax Avoidance Tax Planning And Tax Evasion Html

Actionaid Australia On Twitter Acting Education Health Care

Africa And The Corrosive International Tax System Tax Justice Network

What Influences Tax Rates In Sub Saharan Africa Center For Global Development

Differences Between Tax Evasion Tax Avoidance And Tax Planning